Abstract

If health care expenditure for the elderly grows faster than for younger people, the expenditure profiles become “steeper” – we call that “steeping”. Three instruments for measuring “steeping” are presented: (1) trend of the relation between per capita expenditure of the old and the young; (2) comparing the linear slopes of per capita expenditure in age groups; (3) trend in parameters of nonlinear modelling of expenditure profiles. Using data of the largest German private health insurer over a period of 18 years, “steeping” could be observed by all three methods in most examined insurance plans. There are some hints that steeping also occurs in Germany's social health insurance system. The impact of steeping on the sustainability of the health system is discussed. Consequences for the calculation methods in a capital-funded health insurance system and for the implicit inter-generational contract within a pay-as-you-go financed social health insurance system are analysed. The link between “steeping” and the topic of the “red herring” discussion is elaborated.

Similar content being viewed by others

Introduction

Ageing of the population is increasingly seen as a problem for health care systems. For instance, in Germany the ratio of the number of people above 65 years to the number of people from 20 to 65 years will almost double during the next 35 years. As per capita health care costs for the elderly are much higher than for the young (see an example of expenditure profiles in Figure 1), an increasing burden for the payers is forecasted. The fact that health care costs rise with age has attracted the work of many health economists in recent years. Questions such as to what extent it is related to the rising costs within the last months of life have inspired some papers.Footnote 1 Others have focussed on the interaction of demography with technological change and innovations in health care provision.Footnote 2

The Footnote 3paper adds to this discussion. One of the questions hardly addressed beforeFootnote 4 is the long-term development of expenditure profiles. Using a data set of a large German private health insurance fund covering 1979–1996, we examine whether health care expenditure for the elderly grows faster than for younger people – a phenomenon we call “steeping”, because expenditure profiles in that case become “steeper”. We want to analyse to what extent “steeping” occurred with regard to total expenditure, but also for outpatient and inpatient care separately. We also use data of Germany's social health insurance system to analyse “steeping”, although due to data restrictions only a rather undifferentiated analysis can be done.

If “steeping” can be observed, and if we assume that it will happen in the future as well, consequences for the sustainability of financing health care systems are quite straightforward: the future increase of health care costs will even be larger than in predictions which keep expenditure profiles constant. In pay-as-you-go systems (like almost all social health insurance systems), the burden for the implicit inter-generational contract between the net-payers (young) and net-recipients (elderly) will increase as well.

The correlation between the steeping effect and the so-called “red herring” hypothesis is not so straightforward. The “red herring” hypothesis sees most or all of the increase of per capita expenditure with age explained by proximity to death.Footnote 5 A priori, proximity to death could not only be (partly) responsible for an increase of per capita expenditure with age but also for steeping. In that case, health care steeping would not be observable in the health care costs of the survivors. We will return to this issue in the last section.

The rest of the paper is organized as follows: The next section gives a short background on the German health insurance system as far as needed for this study. The following section describes the data, and in the next section, the methods are developed for measuring the phenomenon of steeping. The penultimate section presents the results of employing these methods. In the last section, the results are discussed. There we also discuss the consequences of steeping for the sustainability of the German health care system, and we will return to the question of how “steeping” is related to the “red herring” discussion.

Short background on the German health insurance system

Germany has a dual system of health insurance. Whereas most employees are mandatorily insured within social health insurance (sickness fund systems), high-income employees, self-employed and civil servants can opt out and choose private health insurance instead. In consequence, almost 90 per cent of the population are insured with one of the about 250 sickness funds. More than 10 per cent of the population have insurance policies with private health insurance companies as their main source of coverage. From those insured with social health insurance, about 20 per cent have supplemental insurance with one of the almost 60 private health insurance companies.

Long-term data on the development of per capita expenditures as needed to investigate the “steeping hypothesis” are available only for private health insurance. As private health insurers in Germany calculate risk-related premiums on a capital-funded base, they have to know per capita expenditures by age and gender. In social health insurance however, which works according to the solidarity principle with the pay-as-you go mechanism, insurers traditionally were not even allowed to differentiate their health care expenditures along risks groups (such as age and gender). In 1995, a risk-adjustment mechanism was implemented in social health insurance, with age and gender as risk adjusters. Since then expenditure profiles can also be constructed for social health insurance. However, in the first years, the database for risk adjustment had to be built up gradually and the accuracy of the data improved over the years. Also, several major changes in the benefit package of social health insurance were implemented by law; they had their impact on annual expenditure profiles. Therefore, effects of steeping cannot be disentangled in social health insurance from the effects of improving the database and effects of changes in the benefit package. Longitudinal data from private health insurance are most suitable therefore for studying the development of expenditure profiles.

Private health insurers calculate their premiums on a capital-funded basis. At present, insured “lose” their accumulated capital when switching between private insurers. Switching by insured who already have spent several years with one insurer is rather seldom as a consequence.Footnote 6

Health care providers in Germany provide services for the sickness fund system as well as for people with private insurance. In general, they receive higher reimbursements for treating people with private insurance, and since cost containment in social health insurance has been intensified, the issue of preferential treatment of private patients has increasingly been discussed in recent years.

Data

DKV, a large German private health insurance company with about 2.9 million insured, for this study provided the data of their main health plan system with a total 0.6 million insured in 1996 (see Table 1). In the analysis, we included two outpatient plans with different deductibles (called OUTPATIENT1 and OUTPATIENT2) and their main inpatient plan (called INPATIENT). We also included their main supplementary plan, which includes inpatient services not covered by the benefit package of public health insurance (called SUPPLEMENTARY). In what follows the data for men in the plan, INPATIENT is used to illustrate the results graphically. The benefit packages of these health plans include acute care, no long-term care and (only to a limited extent) rehabilitation.

Although the DKV data are probably the best available for studying the hypothesis of steeping for Germany, nevertheless there are some clear limitations. First, it is data from private health insurance. The people who have private health insurance are likely to be wealthier and healthier than members of the sickness fund system. This can also have an influence on the topic of steeping (we come back to this issue in the last section). The effect is less probable in the plan SUPPLEMENTARY for insured from the public system, where adverse selection and medical underwriting may have opposite effects.

Second, the data are not available for single insured, but only as an annual sum of expenditure for an age group (aggregating for example the insured of age 30–34 years) and the number of insured within each age group for each year of the observation period from 1979 to 1996. So average per capita health care expenditure can be calculated by dividing the total health care expenditure within an age group by the number of insured within this group in the same period of time.

Special problems arise within the health plan system of the DKV, because in 1986 a new outpatient plan without any co-payment (OUTPATIENT0) was introduced, whereas the plans existing before all had co-payments. This new plan was growing very fast: Within 5 years, it became the outpatient plan with most insured persons, and within 8 years there were more people insured in the new plan than in all other outpatient plans together. This had an impact on the expenditure profile of the old plans: some insured persons – because of adverse selection probably more of the less healthy – changed from a plan with co-payment regulation to the new plan. Additionally, most of the new insured chose the new plan, causing an ageing within the old plans. This might have had an effect on the development of the expenditure profile, and therefore could influence the validity of our findings on steeping.Footnote 7

Methods

We present a retrospective study on aggregate data. The dependent variable is the per capita health care expenditure; independent variables are the year of observation, gender and age group. Because individual data are not available, the unit of the observation is a “(gender-specific) age group year”: the smallest available unit of time is a year and the smallest unit of the sample of insured is the (gender-specific) age group.

Composing expenditure profiles

The starting point for the research of steeping is the expenditure profiles. In general, there are two ways of putting together age-specific per capita expenditure to compose expenditure profiles: First, for every year of the observation period, the per capita expenditures of the different age groups are put together, forming a specific expenditure profile for every year. The per capita expenditures of different age groups within one profile are caused by different groups of insured. We call this the “year approach”.

Second, for every cohort of insured, the per capita expenditures are put together for an expenditure profile. A cohort is defined by the same year (or decade) of birth. A cohort expenditure profile reflects the per capita expenditure during the life cycle of this cohort. So a cohort expenditure profile is formed by per capita expenditure from different periods of time, but the per capita expenditures used for one cohort expenditure profile come all from the same group of insured. We call this the “cohort approach”.

Both approaches have their pros and their cons: The cohort approach can – at least up to a certain degree – distinguish between the effects of special birth cohorts and the effects of time trends. But this approach puts together expenditure profiles using per capita expenditure from different periods of time. So it is necessary to filter the effect of (medical) inflation. The year approach can easily be calculated, and there is no problem of data coming from different time periods within one expenditure profile. This approach is used by German private health insurance companies for their premium calculation,Footnote 8 so do most academics for prognosis.

Given the structure of data (no identification of health plan switchers possible, aggregation of five-year age groups), the cohort approach could have been calculated only with a lot of constraints and loses most of its pros. Considering all these issues it is evident that using the year approach is the best choice for investigating the steeping hypothesis, at least with the data given. So we applied the year approach.

The range of age of the insured used for this investigation was limited from 30 to 79 years, what corresponds to the age groups 7–16 years. We had several reasons for introducing this constraint: Owing to regulation of membership of mandatory social health insurance, there is a lot of entering into and leaving private health insurance companies below the age of 30 years. Switching from a private insurance plan to public insurance or to another private insurance company is reduced significantly after the age of 30 years. The number of insured in the sample cells of higher age groups, especially above 80 years becomes too small for analysis.

Figure 2 shows in a three-dimensional diagram the idea of steeping. The expenditure profiles of the health plan INPATIENT for the age range of 30 to 79 years using the year approach are set side by side for the years 1979–1996. It can be seen that the profiles become steeper over time. This is no monotonous phenomenon, but the change of the shape of the expenditure profiles is shown clearly. The effect of steeping is boosted in this diagram by inflation. We will face this effect in our calculations.

More difficult than showing the effect in a graphical illustration is to show the effect by mathematical or statistical methods. With such statistical methods, we can separate the effect of inflation from the pure steeping effects. Also with some of these methods we can study in which periods, for which health plans and for which age groups steeping is especially relevant.

Three methods to measure steeping

To compare expenditure profiles especially referring to their age-specific per capita expenditure trend and to disentangle steeping from inflation, special instruments are needed. Because so far no such measuring instruments have been published, we develop three different methods. The methods are the age-cut method (ACM), the age group-specific expenditure increase (ASI) and the exponential profile modelling (EPM). To measure steeping, we only use raw data; there is no smoothing or balancing used for composing the expenditure profiles. This ensures that no effects of any additional procedures can overlap real steeping effects or create artificial steeping effects.

ACM

This method separates the insured into two groups: the older and the younger. For the segregation, a specific age is chosen as cut-point (in this case, we used the age of 65 years). All insured younger than this age threshold in a given year are “the young” insured and all insured equal to or older than this threshold are “the old” insured. For both groups their average per capita expenditure in that year is calculated and the per capita expenditure of “the old” (PCE65+) is divided by the per capita expenditure of “the young” (PCE<65).This “age-cut relation” AR65 shows how steep the profile is, and if the relation is increasing over time, then this is a sign for steeping. Summarizing, we use the following formula for the ACM:

A problem of this method is the strong influence of demographic age trends within the two groups on the quotient. In case average age is increasing in the older age group and average age keeps constant in the younger age group, the “age-cut relation” will increase, showing a (misleading) sign of steeping although the profile did not change at all.

The ACM controls for the effect of inflation in the health sector automatically: If inflation is modelled by a factor which has the same value for all insured, multiplying PCE65+ and PCE<65 with that factor does not change the value of the age-cut relation. An advantage of this method is its simple calculation and its high transparency. The two main disadvantages of this method are the high aggregation of data before the calculation of the index really starts, and therefore the loss of a lot of information, and the strong influence of demographic trends on the results of this method.

ASI

With this method, within each age group the increase of per capita expenditure during the observed period is calculated. These age group-specific increases are compared. A stronger increase in the higher age groups than in the lower age groups shows a steeping of the profile. To measure the increase of age group-specific per capita expenditure, we used a linear regression approach using the following formula

PCE Y AG is the per capita expenditure of year Y in age group AG, a and b are the values of the linear regression calculated by OLE. Slope b forms a measure of the average per capita expenditure increase of every age group during the observation period. For each profile, we get ten age-specific slope parameters b, because of the ten age groups investigated (7–16 years).

For an unbiased comparison of the trends in per capita expenditure among different age groups, the per capita expenditure of each year has to be standardized. We do this by dividing all per capita expenditure of the single age groups by the value of the lowest age group of the used age range, which is age group 7 (30–34 years). So age group 7 gets the value 1 in standardized profiles, and the slope b in this age group will therefore be 0 for all the investigated health plans. If we did not standardize the expenditure profiles but used the absolute per capita expenditure for each age group, inflation (or a for all age groups equal growth rate) would create a higher value of slope b within the higher age groups than within the lower age groups – without any real steeping effect. After standardization, parameter b is no longer an average of increase in annual per capita expenditure of each age group. Instead it reflects the average annual growth rate of per capita expenditure relative to the growth rate in the lowest age group used (AG 7).

For this method, we also used a multilinear approach with the following model equation

The dummy variables are 1 for the respective age group and zero for the rest of the cases. In this multilinear approach, we get for each health plan and each gender ten different slope parameters from one model. The absolute value of parameter b is a kind of average annual growth rate in comparison to standard age group 7. The average is built over all age groups. At the same time, parameter b stands for the slope of age group 7; this makes sense because in its negative form it forms the difference between the average slope and the age group 7 slope. For the other age groups, the sum of the respective age group slope parameter and the slope parameter b forms the deviation from the average slope.

The age group-specific expenditure increase shows whether the steeping is spread in the same way over the whole age range we investigated or not. For example, it would detect if there is an age threshold up to which there is no steeping, but exceeding this age threshold the increase of per capita expenditure is definitely higher than in the age groups below the threshold. The strength of the age group-specific growth rate is the good graphical transparency and the independence from the age range.

EPM

Besides the health plans for dental care, an exponential function seems to be a good approximation for the expenditure profile of all health plans, especially for the age range of 30–79 years. We use a standardized exponential model including an additive variable, represented by the following formula

PCE AG is the per capita expenditure of age group AG (age group 7–16 years). The modelling function is characterized by two parameters c and d, which are calculated by nonlinear modelling described in more detail below. The exponential parameter d forms a measure of how steep an expenditure profile is. For every health plan we investigated, this method gives 17 values of the parameter d, because of the 17 years of observation from 1979 to 1996. The absolute value of the parameter d is not important in this context; important is the trend of this parameter over time. If the values of parameter d increase over some years, the profile becomes steeper.Footnote 9 Again standardization was performed to elude any bias by inflation.

High values of R2 demonstrate the good adoption of the data by the exponential model. For most years and plans, the value of R2 is over 90 per cent and there is no trend in the values of the R2 over the observation period.

The model cannot be linearized, so methods of linear models and generalized linear models cannot be used for parameter calculation.Footnote 10 Besides estimating the model parameters, several statistical measures are calculated. Instead of the normally used variances and confidence intervals, asymptotic standard error and asymptotic confidence intervals are calculated for the nonlinear regression parameters. These are values of the linear regression model, created by linearizing the model function around the estimated model parameters. This approach assumes that the linearized model gives a good approximation of the nonlinear model.Footnote 11

The strength of using the model (3) is that one parameter can characterize how steep the expenditure file is, and the whole information is used for the parameter calculation. The bias of inflation is excluded. Disadvantages of this method are the complex calculations, that make it impossible to use this method without a powerful software, the lack of immediate transparency, and the fact that there is no clear and concrete meaning of the parameter d external to our measuring of steeping.

The strength of all three methods presented in this section is that there is no other data used from outside the data set, like cost or price indices, to standardize the data. The use of such external indices may cause bias compared to the calculation within the “closed systems” of the used data.

Results

Age-cut method

As described above, in the ACM, steeping is expressed as an increase of the age-ratio during the observation period. A graphical illustration is given in Figure 3 for the men in health plan INPATIENT: the age-ratio in that plan increases from a value of 4.3 (1979) to a value of 6.5 (1996). This means that the average per capita expenditure of insured older than 64 years in 1979 is “only” 4.3 times the average per capita expenditure of insured younger than 65 years, whereas until 1996 this relation increased up to a value of 6.5. Average age within the younger group is kept within a range of 39–41 years, average age within the older group is kept within a range of 72–73 years. So we can assume that in this case the impact of changes in the age structure on steeping is very small, and they do not influence the phenomenon of steeping as measured by the ACM.

We do find a special situation for health plan OUTPATIENT1: the course of the age-ratio of men in this plan is very different from the course in all the other plans and for women in the same plan. Until 1985, a steep rise of the age-ratio can be observed from a value of 3.5 to a value of 4.5; from 1986 on, the value is decreasing to a value of 3.7. At least a partial explanation for this unexpected course of the parameter may be the fact that the average age within the younger age group increases by 7 years from 36 to 42 years, whereas the average age within the older age group keeps more or less constant at the value of 73. More important seems to be the fact that the new outpatient plan OUTPATIENT0 without any co-payment regulation was introduced in 1986 and that many insured switched especially from OUTPATIENT1 to OUTPATIENT0, because health plan OUTPATIENT1 was the plan with the lowest co-payment regulation so far.

To get an idea of how sensitively this method reacts on different age-cut points, we perform this method by using the age-cut point of 60 years. The results show only slight differences with the results when using the cut point of 65 years. The movements around the general trends are smaller, because the “old age group” becomes bigger, balancing outlier effects better in this group.

To summarize, in all the health plans investigated, age-ratios do increase over the period of observation, including some upward and downward movement (see Table 2). The only exception is health plan OUTPATIENT1 for men. There is less upward and downward movement in the course of the age-ratio of inpatient health plans than of the outpatient plans; the smoothest increase of age-ratio is observed for health plan SUPPLEMENTARY. This may be due to the higher number of insured in the inpatient health plans.

Age group-specific expenditure increase

This method uses the linear slope as average annual per capita growth within the different age groups, and steeping is shown by an increase of the “standardized” slope (parameter b), comparing younger age groups with older age groups.

In health plan INPATIENT for men, parameter b is increasing from age group to age group almost monotonously (see Figure 4). Only in the age groups 8 and 10 (35–39 and 45–49 years) are small deviations from this rule observable. For the higher age groups, the increase of b becomes bigger. For men in plan INPATIENT, the form of the bar diagram of parameter b shows the form of an exponential function.

We can see generally in diagrams of the inpatient plans an almost monotonous increase, and an exponential form of the bar diagram is seen. The bar diagram for health plan SUPPLEMENTARY is even smoother than for health plan INPATIENT.

For the outpatient plans within the lower age groups, a decreasing parameter b is observed, falling into negative values.Footnote 12 Between age groups 10 and 12, parameter b begins to increase in the two outpatient plans up to age group 16. Dividing the period of observation in two parts – one before the introduction of the co-payment free plan and after its introduction – we get the following pattern: Until the mid-1980s (including 1985) we get a clear – and for plan OUTPATIENT1 very smooth – increase of parameter b. From 1986 to 1996 no clear pattern can be recognized, but most of the values of parameter b are negative and there is definitely no sign of steeping.

Comparing all health plans it seems to be a rule that the highest linear slope is observed in the highest age group. An investigation of the range of values shows that slope values are higher for men than for women, and for both sexes they are higher for inpatient plans than for outpatient plans; they are larger with larger deductibles.

Looking at the significance of parameter b, the results described so far can be confirmed: For age group 7, the slope parameter b of linear regression has to be 0 in this method by definition. So for the age groups close to age group 7, no values significantly different from 0 are expected. For the inpatient plans, there is again quite a uniform pattern: in higher age groups (in most of the cases from age group 10 onwards) the slope is significantly different from 0. Less clear is the situation for the outpatient plans: only for some plans can we find the above-described pattern. The reason for this difference is the above-described situation. The steeping in higher age groups is reflected by values of parameter b, which increase from negative values to positive values. So there is steeping within the higher age groups but no parameters b, which are significantly different from 0. Restricting the observation period to the time before the introduction of plan OUTPATIENT0, we get the expected pattern of parameters b significantly different from 0 in higher age groups as well as in inpatient plans.

The multilinear approach confirms the described results and shows steeping very clearly (see Table 3). The age group-specific slope parameters are increasing monotonously from age group to age group in all described health plans for both genders. In this context, the outpatient health plans were not restricted to the years before the introduction of the plan OUTPATIENT0 (excluding the years after introduction of the new health plan makes the picture even clearer). Steeping becomes stronger in the higher age groups.

The “average slope” b is significant on the 95 per cent level for all described health plans and both genders. Age-specific slope parameters are not all significant but at least from age group 12 upwards they are significant on the 95 per cent level again for all described health plans and both genders. To summarize, we can see steeping – measured by ASI – in all plans investigated. In outpatient plans, it is observed only for the higher age groups or only before the introduction of plan OUTPATIENT0.

Exponential profile modelling

This method approximates the expenditure profile by an exponential function, and steeping is shown by an increase of the exponential parameter d over the observation period.

For a graphical illustration for men in the INPATIENT plan, see Figure 5. The figure shows that there is some upward and downward movement, but nevertheless d is clearly increasing over the whole period of observation from 1979 to 1996. For the plans OUTPATIENT1 and OUTPATIENT2 until the years 1983, respectively 1984, for both sexes a steep rise of parameter d is observable, indicating a strong steeping of the profiles in this period. Afterwards parameter d is decreasing somewhat, ending in some up and down movement of the parameter. For the inpatient plans, we can observe steeping over the whole period of observation. Especially in plan SUPPLEMENTARY the increase is very smooth.

To get an idea of how sensitively this method reacts to different age restrictions, we perform the method as well, using the age range from 50 to 70 years. Only few differences in the trend of the development are found.

To summarize, we observe a steeping (measured by EPM) in the inpatient plans and until the mid-1980s in outpatient plans (see Table 4). For the time afterwards, no clear statement for outpatient plans is possible based on the used data.

Discussion

This paper has demonstrated that a considerable amount of “steeping” can be observed at least for the period of the 1980s and the 1990s of the last century within the data from the large private health insurance we used.

There are, however, some limitations of the study: We have discussed already the fact that data are not on an individual person level but on the level of age groups within types of health insurance policies. Therefore, studies on the reasons for steeping, which would need data on the individual level, cannot be performed. Special problems arising from changes within the health plan system of the DKV have been mentioned.

Another limitation is that data are from just one private health insurance company. We therefore tried to collect information on whether steeping is observable elsewhere in the German health care system as well.

We did the same investigations on some aggregate data of the Association of Private Health Insurance Companies (PKV-Verband) from 1970 to 1996, in which almost all of the German private health insurance companies are organized. The problem of this data is that it is not possible to determine which company delivered which data for which health plan in which year. So changes in the structure of the delivered data could have caused effects that may interfere with steeping effects. Owing to restrictions in the structure of the data, it was also not possible to test the ACM; however, we could calculate parameters for age group-specific expenditure increase and for EPM. For both methods steeping can be established in this data: steeping is seen also in the 1970s, especially in the inpatient plans; the results are quite similar for this data in comparison with the DKV data, especially in the 1980s; however, in the 1990s in the data of the private health insurance association steeping cannot be established. Altogether we can conclude that steeping is observed not only in the DKV portfolio, but also in the whole population of the private health insurance sector in Germany.

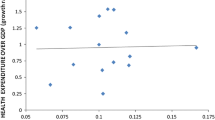

It is also very useful to compare our results with data from the social health insurance system – as far as it is possible. As mentioned above, longitudinal data for age expenditure profiles for the observation period cannot be constructed for social health insurance. However, for administrative reasons, routine data of social health insurance can be differentiated into the two “age groups” of “pensioners” and “non pensioners” – although these do not coincide with any real “age groups”: some “pensioners” are below age 60 (for instance even orphans who receive social security benefits are counted as “pensioners”) and some “non pensioners” are beyond age 65; also the values for per capita expenditures are available only for “members including dependent”, not per insured. However, with these limitations the “age cut method” can be applied with ARP/PN=PCE P /PCE NP , where PCE P and PCE NP are the per capita expenditure for pensioners P, respectively, non-pensioners NP and ARP/NP is the age-ratio between these two groups.

Figure 6 shows the development of ARP/PN for the period from 1950 to 1996. It can be clearly seen that there was steeping during the whole period and also during the period from 1979 to 1996, for which we have our DKV data. Whereas ARP/NP was 0.47 in 1950, it was 1.08 in 1979 and 1.76 in 1996. As these values are “per member” and the elderly have considerable less insured children than the younger, the quite low values of AR P/NP cannot be a surprise. What is interesting for us, however, is the trend of this value, which confirms steeping.

Therefore, it seems plausible to generalize our conclusions regarding the steeping hypotheses from the DKV data to more general populations in Germany.

Steeping will cause different effects in different financing systems. In terms of inter-generational fairness in health care systems financed by the pay-as-you-go mechanism, steeping provides a paradox: On the one hand, it means that each generation will be “winning”, because it gets more out of the system than it has paid into the system. At the same time, in an ageing population steeping leads to rising per capita expenditure and increases the burden for publicly financed health care systems. Especially the younger generation has to face this increasing burden in such a situation. It is unlikely that in the long run the younger are willing to finance the consequences of steeping, not knowing whether the next young generation will bear the burden when they reach old age and need the financial support of this next young generation. Steeping therefore undermines the trust in the functioning and reliability of such publicly financed health care systems and the implicit contract of generations, which stands behind the pay-as-you-go system.

In a capital-funded system such as the German private health insurance, the phenomenon of steeping should be integrated into the calculation method. Using steep enough expenditure profiles which already cover the future trend for calculating the age reserves may be an alternative.

Another consequence of steeping is its impact on future health care costs. A variety of predictions for (per capita) health expenditures for Germany and for the contribution rate of social health insurance have been published. As far as these calculations consider “pure” demography, they conclude that per capita expenditures will rise by between 15 and 25 per cent due to double ageing from now until 2030/40.Footnote 13 If one includes some dynamic trend, which has been taken from the past, per capita expenditure rises by more than 50 per cent in that period.Footnote 14 Steeping may be one of these dynamic factors. Therefore, steeping should be considered in any prognosis of future health expenditure. Already without steeping there are deep concerns among policy makers about the financial consequences of ageing for the health care system. With steeping, the consequences for the sustainability of the German health care system will even be stronger. Society will have to decide whether it wants to spend an increasing part of GDP on mandatory health insurance or whether it wants to decrease the value of the publicly delivered health package.

We could also address the very interesting question of the correlation between the just-described steeping effect and the so-called “red herring” hypothesis. The latter sees most or all of the increase of per capita expenditure with age explained by proximity to death.Footnote 15 This question was investigated recently using very similar methods as in this paper using DKV data from 1993 to 2002.Footnote 16 All three used methods show steeping of expenditure profiles for the inpatient plan among the insured surviving from 1993 to 2002. So the steeping effect does not disappear without costs in the last year of life. We can conclude that dynamics in the costs of the survivors are responsible for – at least part of – the steeping effect. Expenditure profiles, including costs of the deceased people in 2002, are steeper than expenditure profiles excluding these costs. Steeping is observed in both groups and the figures do not vary considerably. This may lead to the conclusion that there is only a minor influence of cost of dying/proximity to death on the steeping effect, but additional investigation is necessary in this context.

We could not answer the question, with the data available for this study of why steeping happens. Referring back to the general discussion on ageing and health care expenditures, it seems likely that technical change and innovation are key drivers for health care expenditures.Footnote 17 One potential explanation for steeping is that the elderly profit more from these innovations (new surgical procedures, new drugs) than do the young.

Notes

The expenditure profile in Figure 1 includes inpatient, outpatient and dental care. Here and in what follows age group 0 is for insured below 1 year, age group 1 is for insured with age 1–4 years, age group 2 for insured with age 5–9 years, age group 3 for insured with age 10–14 years. We calculated Age=year of observation–year of birth.

See, however, Polder et al. (2002).

We do not report the results with regard to steeping for OUTPATIENT0 in this paper, because the time-period of observation is much shorter for the new plan than for the other plans. Additionally, the cost development in a very new plan is different from older plans, and this particular behaviour could distort the picture that we want to analyse.

The question may arise, why we do not use the standard model of exponential modelling including a multiplicative variable, represented by the following formula

With this specification not only parameter d, but also parameter c influences the slope of the curve, as can be seen by the derivation of the model function, assuming the age variable x is continuous. The multiplicative variable does not disappear in the deviation function and shows in this way its influence on the deviation and the slope of the curve

In contrast, the additive variable disappears in the deviation function of this specification with an additive variable:

.

To optimize the approximation of the model to the data we minimized – as is standard – the squared errors. To solve the minimizing problem, the partial derivatives of the model function with respect to the two model parameters c and d are set equal to zero (the continuous variant of the model function is differentiable). These equations are called “normal equations”. Generally, they can be solved only approximately, because it is not a system of linear equations. For the iterative process of approximation, we choose Marquardt method, which is a compromise between Gauss–Newton method (Linearisation/Taylor-series) and steepest descent. The advantage of the chosen method – it converges relatively fast. (SAS Institute (1990); Draper and Smitz (1998)).

This does not reflect decreasing per capita expenditure in these age groups, but growth rates, which are smaller than the growth rate of age group 7.

For an overview see Wasem and Hessel (2002).

References

Bohn, K. (1980) Die Mathematik der deutschen privaten Krankenversicherung, Karlsruhe, Germany: Verlag Versicherungswirtschaft.

Breyer, F. and Ulrich, V. (2000) ‘Gesundheitsausgaben, Alter und medizinischer Fortschritt: eine Regressionsanalyse’, Jahrbücher für Nationalökonomie und Statistik 220 (1): 1–17.

Buchner, F., Rodrig, S. and Wisemann, H.-O. (2005) The Steeping of Health Expenditure Profiles and the Cost of Dying, Poster presented at iHEA-conference 2005, Barcelona.

Draper, N. and Smitz, H. (1998) Applied Regression Analysis, Hoboken, NJ: John Wiley & Sons.

Dufner, J., Jensen, U. and Schumacher, E. (1992) Statistik mit SAS, Stuttgart, Germany: Teubner.

Erbsland, M. and Wille, E. (1995) ‘Bevölkerungsentwicklung und Finanzierung der gesetzlichen Krankenversicherung’, Zeitschrift für die gesamte Versicherungswissenschaft 84: 661–681.

Meyer, U. (1994) ‘Gesetzliche Regelungen zu den Berechnungsgrundlagen der privaten Krankenversicherung”, in H.-P. Schwintowski (ed.) Deregulierung, Private Krankenversicherung, Kfz-Haftpflichtversicherung. Beiträge der Dritten Wissenschaftstagung des Bundes der Versicherten, Baden-Baden, Germany: Nomos, pp. 86–111.

Newhouse, J.P. (1992) ‘Medical care costs: How much welfare loss?’, Journal of Economic Perspectives 6 (3): 3–21.

Polder, J., Bonneux, L., Meerding, W. and Maas, P.V.D. (2002) ‘Age-specific increases in health care costs’, European Journal of Public Health 12: 57–62.

SAS Institute (1990) SAS/STAT User's Guide, Version 6 Fourth Edition, Volume 2, Cary, NC: SAS Institute.

Schubö, W., Uehlinger, H.M., Perleth, C., Schröger, E. and Sierwald, W. (1991) SPSS: Handbuch der Programmversion 4.0 und SPSS-X 3.0, Stuttgart, Germany & New York: Fischer.

Seshamani, M. and Gray, A. (2004) ‘Ageing and health care expenditure: the red herring argument revisited’, Health Economics 13: 303–314.

Wasem, J. and Hessel, F. (2002) Die Krankenversicherung in einer alternden und schrumpfenden Gesellschaft, Münsteraner Reihe 68, Karlsruhe, Germany: Verlag Versicherungswirtschaft.

Zweifel, P., Felder, S. and Meier, M. (1999) ‘Ageing of population and health care expenditure: A red herring?’, Health Economics 8: 485–496.

Zweifel, P, Felder, S. and Werblow, A. (2004) ‘Population ageing and health care expenditure: New evidence on the “red herring”’, The Geneva Papers on Risk and Insurance — Issues and Practice 29 (4): 652–666.

Acknowledgements

This paper presents the results of a research project financed by the Bavarian Public Health Research Center in Munich. The authors gratefully acknowledge the support of the Deutsche Krankenversicherung AG (DKV) for the database they made available. The authors thank Norbert Bleckmann of the DKV and Jürgen Schmidt of the Bayerischen Beamtenkrankenkasse as well as Ulrich Hornsteiner from Munich Re for their helpful comments and Dr. Manfred Wildner from the Bavarian Public Health Research Center for his support. We thank an anonymous reviewer for useful comments. We also thank the participants of the iHEA-conference 2001 conference in York, where the poster presentation of this paper won the first poster prize, for their comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Disclaimer

This article expresses the opinion of the authors and not necessarily of Munich Re.

Rights and permissions

About this article

Cite this article

Buchner, F., Wasem, J. “Steeping” of Health Expenditure Profiles. Geneva Pap Risk Insur Issues Pract 31, 581–599 (2006). https://doi.org/10.1057/palgrave.gpp.2510100

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.gpp.2510100